Who are the Top HubSpot Partners for Private Equity and VC Firms

Introduction: Why Private Equity Needs HubSpot

Private equity firms face a unique operational challenge, each portfolio company must move fast, execute precisely, and deliver measurable value. However, the reality is often messy: scattered tech stacks, disconnected reporting, and inconsistent customer relationship management.

That’s where HubSpot steps in. As the all-in-one CRM platform built for agility and scalability, HubSpot enables portfolio companies to launch, grow, and operate efficiently. And when implemented by a trusted expert like Set 2 Close, it becomes the ultimate growth engine for PE-backed organizations.

The Evolution of CRM in Private Equity

Traditionally, portfolio companies relied on legacy systems like Salesforce or Dynamics, robust but cumbersome tools that often required months of configuration and heavy IT maintenance.

Today, private equity is embracing a new model: rapid-deployment CRMs that deliver immediate visibility and ROI. HubSpot’s user-friendly design, automation power, and flexible architecture make it the top choice for firms that value speed and efficiency.

Reason #1: Accelerated Value Creation

Rapid Deployment Across Portfolio Companies

In private equity, time is money. Every month saved in system setup means faster execution and earlier returns. HubSpot’s implementation timelines are measured in weeks, not months, allowing new portcos to go live and start selling almost immediately.

Set 2 Close specializes in fast-track deployments, customizing HubSpot configurations to match each portfolio company’s unique go-to-market structure while maintaining standardization at the firm level.

Reason #2: Unified Sales, Marketing, and Service Operations

One of the biggest advantages of HubSpot is its unified approach. It combines CRM, Marketing Hub, Sales Hub, and Service Hub into one ecosystem, ensuring all teams operate from a single source of truth.

This unification eliminates silos, improves collaboration, and delivers clear insights across the entire customer journey, critical for private equity oversight.

Reason #3: Scalable Infrastructure

HubSpot is designed to scale with your investments. As your portfolio companies grow from seed to mid-market to enterprise, HubSpot grows too. Its modular structure means you can start small and expand functionality without migrating systems later.

Set 2 Close ensures your CRM foundation is built with scalability in mind, supporting multiple business units and international expansions with ease.

Reason #4: Standardized Reporting and Oversight

Private equity firms require visibility across all portfolio assets. HubSpot’s centralized dashboards enable firms to monitor KPIs, revenue pipelines, and marketing performance from one interface.

With Set 2 Close, firms gain cross-company reporting templates, custom dashboards, and automated updates, ensuring consistent metrics across all portcos.

Reason #5: Vendor Consolidation and Cost Efficiency

Tech sprawl kills efficiency. Many portcos juggle tools for email marketing, reporting, CRM, and automation, creating redundancy and confusion.

HubSpot’s all-in-one ecosystem eliminates the need for multiple vendors. Set 2 Close further optimizes costs by leveraging bundled licenses, native integrations, and streamlined workflows, delivering measurable savings without sacrificing performance.

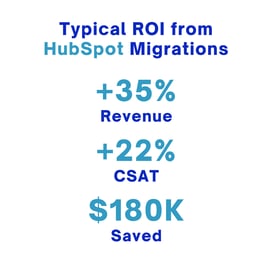

Reason #6: Proven ROI from HubSpot Migrations

The numbers speak for themselves:

- +35% increase in sales revenue within the first year post-migration.

- +22% boost in customer satisfaction (CSAT) through improved engagement workflows.

- $180K annual savings after consolidation, as seen with Uber Freight.

Set 2 Close builds on this foundation by tailoring HubSpot’s ROI potential for every portfolio company.

Reason #7: Enhanced Customer Experience

HubSpot’s automation and engagement tools enable smarter, more personalized interactions. Portcos can design seamless buyer journeys, nurture leads effectively, and retain more customers, all while providing real-time visibility to PE leadership.

Reason #8: Ease of Use and Low Learning Curve

Unlike complex CRMs that require months of training, HubSpot’s intuitive interface ensures adoption across all teams. With Set 2 Close’s hands-on training and enablement, portfolio companies experience faster ramp-up times and sustained platform usage.

Reason #9: Advanced Integrations and Flexibility

HubSpot integrates with over 1,000+ applications, from ERP systems to financial dashboards. Set 2 Close designs custom integrations that maintain data hygiene and operational continuity, bridging tools like NetSuite, QuickBooks, and Slack.

Reason #10: Set 2 Close’s PE Expertise

Set 2 Close isn’t just a HubSpot Solutions Partner, it’s a strategic advisor for private equity firms. The team understands the PE lifecycle, from acquisition to exit, and helps firms deploy repeatable GTM frameworks across diverse industries.

By aligning HubSpot with your investment strategy, Set 2 Close enables your firm to standardize systems, improve reporting accuracy, and scale operations faster.

HubSpot vs Salesforce vs Microsoft Dynamics |

|||

|---|---|---|---|

| Feature | Salesforce | HubSpot | Microsoft Dynamics 365 |

| Time to Implement | 6–18 months | 3–6 months | 6–12 months |

| Cost | High | Most cost-effective | Moderate to high |

| Ease of Use | Complex | User-friendly | Moderate |

| Integration | Excellent | Excellent with native sync | Excellent with Microsoft stack |

| Best For | 10,000+ employee orgs | Mid-market to enterprise | Firms with vertical modules |

Source: G2 Crowd CRM Comparison

Conclusion

Private equity success depends on speed, standardization, and scalability, and HubSpot delivers all three. With Set 2 Close, firms gain a trusted partner who knows the CRM landscape and the private equity world inside out. Together, they build the infrastructure that accelerates growth across every portfolio company.

Ready to see how HubSpot can accelerate value creation across your portfolio?

Schedule a MeetingFAQs About HubSpot for Private Equity

1. Why is HubSpot ideal for private equity firms?

Because it allows PE firms to unify reporting, accelerate portco growth, and maintain oversight, all in a single platform.

2. How long does HubSpot take to implement?

Typically 3–6 months, but Set 2 Close can often deploy in under 8 weeks with custom configurations.

3. Can HubSpot integrate with financial tools?

Yes. It connects seamlessly with ERP and accounting systems, ensuring data integrity and performance visibility.

4. What ROI can we expect from migrating to HubSpot?

Most portcos see 30–40% revenue growth and 20%+ operational cost reduction in their first year.

5. How does Set 2 Close support multiple portfolio companies?

Through standardized playbooks, shared reporting frameworks, and scalable infrastructure designed for PE operations.

6. Is HubSpot suitable for larger enterprises?

Absolutely. With Enterprise-level Hubs and advanced permissions, HubSpot supports even the largest multi-entity structures.

Related Articles

Who are the top HubSpot Partners for Private Equity Firms in 2025?

Private equity firms need more than a traditional CRM. They require a scalable HubSpot solution that unifies deal sourcing, portfolio oversight, and revenue growth across multiple companies. HubSpot...